Germanium Stocks: A Hidden Gem in the Semiconductor Industry

Ever found a gem that shone a little brighter than the rest? Well, let me introduce you to germanium stocks – a hidden treasure in the semiconductor industry. As technology advances and we rely more on our electronic devices, germanium is becoming more and more important. In this post, we’ll explore why germanium stocks are worth your time, answer some questions and guide you through this amazing market.

What is Germanium?

Germanium is a metalloid with properties that make it a must-have in the semiconductor industry. It’s used in transistors, fiber optics and solar cells among other things. As we get into germanium stocks you’ll see how this element powers our modern lives.

Why Germanium Stocks?

The semiconductor industry is hot and with it comes growing demand for germanium. Here are some reasons to invest:

- Growing Demand: As technology advances the demand for semiconductors is going through the roof. Germanium’s properties make it a key player in this space.

- Supply Constraints: Most of the world’s germanium supply comes from China which can lead to price fluctuations. As countries look to secure their supply chains investing in germanium could be a smart move.

- Future Potential: Analysts predict that demand for germanium will increase significantly over the next decade, driven by innovations in electronics and telecommunications.

Fun Fact

Did you know Germanium was discovered in 1886 but only became important in the 20th century when the semiconductor revolution started?

Germanium Stocks to Buy

If you are looking for germanium stocks consider these companies that are major players in the market:

- Teck Resources: Major germanium producer in North America.

- Indium Corporation: Produces germanium for various applications.

- Umicore: Materials technology and germanium and gallium production.

- Battery Age Minerals Ltd (ASX: BM8): Mines and produces battery metals including germanium.

How to Invest in Germanium

To invest in Germanium:

- Research Companies: Find companies that produce or use germanium.

- Stock Purchase: Buy shares through a brokerage account.

- Consider ETFs: Look for ETFs that focus on strategic metals or commodities that include germanium.

- Follow Market Trends: Keep up to date with market dynamics, supply chain news and geopolitical events that impact prices.

Germanium Price

Germanium’s price is currently $4,079.68 per kg.

Germanium Price Per Kg

As mentioned the price per kg is $4,079.68 which has risen significantly over the past year due to demand and supply constraints.

Germanium Price Per Gram

To convert the price per kilogram to grams:

So the germanium price is approximately $4.08 per gram.

Germanium Price Forecast

Germanium price is volatile but will go up due to increasing demand and supply shortage:

- Current: As of Dec 2024, germanium price is around $4,071.32/ kg, up from previous years.

- Future: Analysts expect it to go up as demand is much higher than supply by 2030. This is due to germanium being used in technology and supply shortage due to geopolitics.

Investing in Germanium Stocks: Spotlight on Battery Age Minerals Ltd (ASX: BM8)

As germanium demand is increasing due to its critical role in the semiconductor and battery industry, investing in companies that explore and produce germanium can be a good opportunity. One such company is Battery Age Minerals Ltd (ASX: BM8) which is exploring germanium and other battery minerals.

Company Overview

Battery Age Minerals Ltd is an Australian mineral exploration company focused on lithium, copper, germanium and zinc. They have several projects:

- Falcon Lake Lithium Project: Located in Ontario, Canada. This is the core of the company’s strategy.

- Bleiberg Project: In Austria, this project has significant germanium claims with zinc and lead.

Founded in 1999 and based in Perth, Australia, Battery Age Minerals is looking to take advantage of the growing demand for battery metals as the world goes renewable and electric vehicles.

Current Market

As of Nov 15, 2024, Battery Age Minerals Ltd’s stock price is $0.095, down 2.06%. Market cap is around $10.23 million. Small cap player in the mining space.

Key Projects

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

| Project Name | Location | Focus |

| Falcon Lake Lithium | Ontario, Canada | Lithium |

| Jessie Lake Project | Ontario, Canada | Lithium |

| Bleiberg Project | Salzburg, Austria | Germanium, Zinc, Lead |

| Tidili Copper Project | Morocco | Copper |

Why Invest in Battery Age Minerals?

- Diversification of Assets: Battery Age Minerals isn’t just about germanium, we also have lithium and copper. Diversification reduces the risk of any one commodity price fluctuation.

- Growing Demand for Germanium: As technology advances and the semiconductor industry grows, demand for germanium will increase. That’s good for BM8.

- Strategic Project Locations: Our projects are in mineral-rich areas, which means higher exploration success rates and lower costs.

- Geopolitical Potential: Recent export bans on gallium and germanium from China could create global shortages. Companies like Battery Age Minerals that are focused on these metals may benefit from price increases and demand as countries look for alternative sources.

Risks

Investing in Battery Age Minerals comes with opportunities but also risks:

- Market Volatility: Mineral prices can move big time due to market conditions.

- Exploration Risk: As a mining explorer BM8 has exploration risk.

- Geopolitical Risk: Changes in trade policies or geopolitical events can impact supply chains and market dynamics.

Germanium in Technology

Germanium is a metalloid with many critical uses in modern technology. Its unique properties make it essential in many areas:

- Semiconductors: Germanium is used in high-speed transistors and integrated circuits due to its high electron mobility, it’s faster than silicon. It’s particularly valuable in high-frequency applications.

- Infrared Optics: Germanium is transparent to infrared radiation, ideal for thermal imaging systems, night vision devices, and infrared detectors. These applications are critical in the military, surveillance, and medical fields.

- Fiber Optics: As a dopant in optical fibers germanium improves light transmission, it’s critical for high-speed telecommunications and internet infrastructure.

- Solar Cells: Multi-junction solar cells with germanium can achieve 40%+ efficiency, critical for space and increasingly for terrestrial solar systems.

- Polymerization Catalyst: Germanium dioxide is used as a catalyst in the production of polyethylene terephthalate (PET), a common plastic.

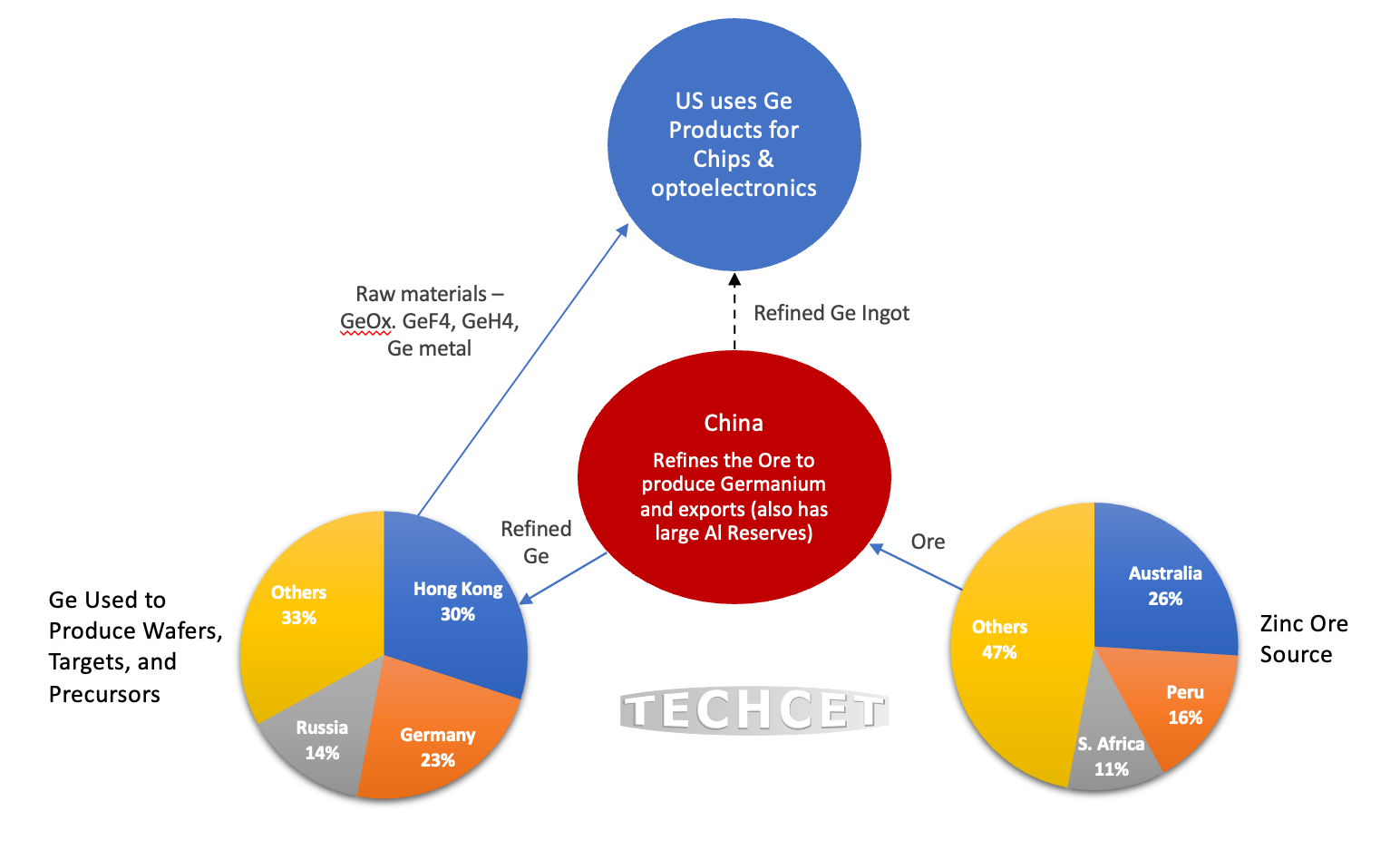

Germanium Supply Chain

The Germanium supply chain is facing big challenges mainly due to geopolitical reasons:

- China’s Dominance: China produces 93.5% of the world’s germanium, so global supply is very dependent on their policies. Recent export restrictions have caused concerns about availability and price stability.

- Market Volatility: The concentration of production in China creates vulnerabilities. Any change in Chinese export policies can cause sudden shortages and price hikes and affect industries that rely on germanium.

- Import Dependency: Countries like the US, Europe, and Japan are heavily dependent on imported germanium which means supply chain disruptions and geopolitical tensions are a risk.

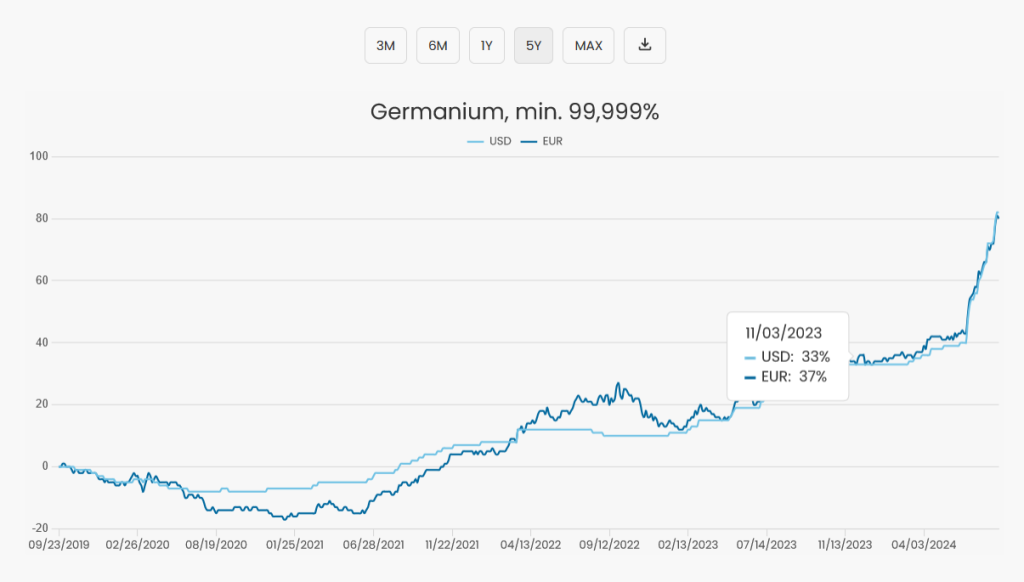

Germanium Price History

Germanium price has gone up and down over the years due to supply and demand,and geopolitical and production cost changes. Here’s the history of its price.

Price History

Below is the price history:

| Date | Price (USD/kg) | Change % to Today | Annual Change % |

| Dec 06, 2024 | $4,071.32 | – | – |

| Jan 1, 2024 | $2,839.40 | +43.39% | – |

| Jan 1, 2023 | $2,344.40 | +73.66% | +21.11% |

| Jan 1, 2022 | $2,293.80 | +77.49% | +2.21% |

| Jan 1, 2021 | $1,984.20 | +105.19% | +15.60% |

| Jan 1, 2020 | $2,045.09 | +99.08% | -2.98% |

| Jan 1, 2019 | $2,361.61 | +72.40% | -13.40% |

| Jan 1, 2018 | $1,845.17 | +120.65% | +27.99% |

Notes

- Recent jump: As of Dec 6 2024 germanium is $4,071.32 per kg. Up 43.39% since Jan 2024 and 73.66% since Jan 2023.

- Long-term: Up 120.65% since Jan 2018 when it was $1,845.17 per kg.

- Volatility: Prices are volatile with big jumps when the supply chain is disrupted and demand increases from various industries.

Price Drivers

- Supply: 80% of the world’s germanium is produced in China. Recent export restrictions in China have further reduced supply in Western markets and pushed up prices.

- Demand: Growing demand for germanium in high-tech applications like semiconductors and fiber optics has increased demand and prices.

- Geopolitics: Ongoing trade tensions between China and Western countries are creating market uncertainty and price fluctuations.

- Production costs: Changes in mining and production costs can also impact prices; higher energy costs or labor costs can increase production expenses.

Geopolitics and Germanium Supply

Geopolitics is affecting germanium supply:

Export Controls: China’s recent export restrictions on germanium and gallium have created market uncertainty. These are seen as retaliatory measures against Western trade policies especially those targeting Chinese technology.

Strategic Resource Management: Countries are now recognizing germanium as a strategic resource. The US and EU are working to diversify their supply chain to reduce dependence on China imports which may involve investing in domestic production or alternative sources.

Major Producers of Germanium

Germanium is a critical metal used in semiconductors and electronics. The germanium production landscape is highly concentrated with a few big players, China being the leader. Here are the major germanium producers around the world.

China

- Production Share: China is the largest producer of germanium, accounting for over 93.5% of global production in 2022. In 2022 it produced around 180 tonnes of germanium.

- Sources: Most of the germanium in China is produced from zinc ores, mainly from Lincang in Yunnan Province and Inner Mongolia. Coal fly ash is another significant source.

- Export Controls: Recent export restrictions have caused supply concerns and impacted global markets dependent on Chinese germanium.

United States

- Production Share: 1.44%

- Sources: Germanium in the US is recovered as a by-product from zinc processing. There are facilities in Alaska and Tennessee that produce germanium-containing concentrates.

- Recycling: The US also can recycle germanium from scrap materials which contributes to the supply.

Japan

- Production Share: 1.44%

- Industry Focus: Japanese companies are involved in germanium processing and utilization, especially in high-tech applications like fiber optics and semiconductors.

Other Producers

- Canada: Canada was a major producer in the past, mainly through zinc mines, and supplies around 25% of the market’s needs from zinc ores.

- Russia: Russia produces a smaller share but has reserves that can be mined in the future, especially from coal deposits in Sakhalin Island.

- Finland and Spain: These countries also supply germanium through their zinc and other metal mining operations.

Summary of Global Production Shares (2022)

| Country | Production Share (%) | Approximate Production (Metric Tons) |

| China | >93.5% | ~180 |

| United States | 1.44% | – |

| Japan | 1.44% | – |

| Canada | – | Significant contributor via zinc ores |

| Russia | – | Smaller share; potential for growth |

Germanium Recycling

Recycling for germanium is gaining momentum as demand grows:

Recovery Processes: New recycling methods can recover germanium from e-waste, solar panels, and other sources. Companies are developing ways to recover germanium from production waste.

Environmental Benefits: Recycling reduces the need for new mining, conserves resources and minimizes the environmental impact of extraction.

Future Germanium Demand

Future demand for germanium will grow for:

- Technological Advancements: The semiconductor industry, automotive (especially electric vehicles), and telecommunications will drive demand.

- Growth Rates: Demand could be 6-9 times supply by 2030 as industries look for more efficient materials for new technologies.

Risks of Investing in Germanium Stocks

Investing in Germanium stocks is risky:

Market Volatility: Prices can move wildly due to geopolitical events or changes in demand.

Supply Chain Disruptions: Chinese production means stability is an issue; any disruption can drive up prices big time.

Regulatory Changes: Changes in environmental regulations or mining policies can impact production costs and availability.

Germanium Market

The germanium market is changing:

Market Size: $315.97 million in 2023 and growing as demand increases across various sectors.

Key Drivers: Germanium-based technologies being deployed across telecommunications, automotive and renewable energy will drive growth.

High Purity Germanium

High purity germanium is required for:

Ionising Radiation Detectors: Medical imaging and radiation monitoring.

Solar Cells: High efficiency solar panels use the properties of high purity germanium.

Germanium Semiconductor Market Growth

Germanium semiconductor market is growing due to:

Technology Advancements: Advancements in semiconductor technology is driving germanium based devices adoption.

Investment Trends: Increased investment in R&D will lead to germanium usage in next gen electronic devices.

Alternatives to Germanium in Electronics

While germanium has its advantages, alternatives are being explored:

Silicon: Still the king but lacks some of the germanium advantages.

Gallium Arsenide (GaAs): For specific applications where efficiency matters.

Emerging Materials: Research into materials like graphene can be a substitute for germanium in some applications.

Global Strategic Metals Market

Strategic metals including germanium market is impacted by:

- Geopolitical Factors: Trade policies and international relations affect the supply chain.

- Technological Demand: The dependence on advanced technology drives the need for strategic metals like germanium.

Frequently Asked Questions (FAQs) about Germanium Stocks

What is germanium and why is it important?

Germanium is a metalloid used in semiconductors and fiber optics.

How has the price of germanium changed over time?

Price has gone up 70% since the start of 2023 due to supply constraints and demand1.

What affects germanium prices?

Supply chain, geopolitics and technology-driven demand1.

Who are the main germanium producers?

China is the biggest producer, 80% of the market1.

Which industries use germanium?

Electronics, telecommunications and aerospace where germanium is used in semiconductors and other high-tech applications.

What are the risks of germanium stocks?

Market volatility, geopolitics affecting supply chain and regulatory changes15.

How can I invest in Germanium stocks?

Invest in companies involved in germanium production or related tech through stock exchange or strategic metals funds.

What is the forecast for germanium demand?

Germanium demand will far outstrip supply by 2030.

Are there substitutes for Germanium in tech?

Research is ongoing but currently, there are no substitutes that match germanium performance in some applications.

How do geopolitical events affect the germanium supply?

Events like trade restrictions or tariffs can cause supply shortages and price increases, in the global germanium market.

Can I Invest in Germanium?

Yes, you can invest in germanium through stocks of companies involved in its production, processing, and application. You can also invest in ETFs that focus on strategic metals or commodities. As germanium demand continues to grow, especially in the semiconductor and tech space, it’s a promising investment opportunity.

How much is Germanium worth?

As of Dec 2024, germanium price is $4,079.68 per kg. Up from $2,839.40 per kg in Jan 2024. Up 43% since the start of the year and 70% since Jan 2023.

Why are germanium prices going up?

Germanium prices are up for several reasons:

- Demand: Germanium is being used more and more in high-tech applications like infrared optics for autonomous vehicles, fiber optics for telecommunications, and semiconductors.

- Supply: China produces 80% of the world’s germanium and recent export restrictions from China have caused supply shortages in Western markets.

- Geopolitics: The ongoing US/China tech and trade tensions have further complicated supply chains and caused prices to go up.

Conclusion

Germanium stocks are a hidden gem in the semiconductor industry, don’t miss out. With demand increasing due to technology and supply constraints from geopolitics, invest now and reap the rewards later.

So what are you waiting for? Get into Germanium stocks today! Whether you’re an old hand or new to investing, this niche market could be your next big score.